what is maryland earned income credit

Maryland Refundable EIC is worth 40 million more this tax season. The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break.

How To File A Maryland State Tax Return

Answer some questions to see if you.

. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. The Earned Income Credit or EIC is a credit that is income based and is initiated by filing Maryland income taxes by April 15th of every year. The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021.

What is the Earned Income Credit. The Earned Income Tax. Married employees or employees with qualifying children may qualify for up to half of.

Eligibility and credit amount depends on your income. The Maryland earned income tax credit EITC will either reduce or eliminate. An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov.

The maximum federal credit is 6728. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. It is a special program for low and moderate-income persons who have been employed in the last tax year.

There is a regular State EIC and a. If you qualify for the federal earned. 33 rows States and Local Governments with Earned Income Tax Credit States and Local Governments with Earned Income Tax Credit More In Credits Deductions.

Earned Income Credit - EIC. Employees who are eligible for the federal credit are eligible for the Maryland credit. The maximum federal EITC amount you can claim on your 2021 tax.

If you qualify for the federal earned income tax credit and. Earned Income Tax Credit EITC Assistant. By Angie Bell August 15 2022 August 15 2022.

The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. How Much Is The Earned Income Credit In Maryland. Earned Income Credit EIC is a tax credit in the United States which benefits certain taxpayers who have low incomes from work in a particular tax.

R allowed the bill to take effect without his signature. The Earned Income Tax Credit also called the EITC is a benefit for working people with low-to-moderate income. The program is administered by the Internal.

It is different from a tax deduction which reduces the amount of. If you qualify you can use the credit to reduce the taxes you owe.

Maryland Department Of Human Services Advises Eligible Marylanders To Utilize The Earned Income Tax Credit Dhs News

Comptroller Of Maryland Shopmd On Twitter Happy Monday Our Earned Income Tax Credit Calculator Is Live On Our Website You Can Find It Here Https T Co E5uz39xsac Https T Co Lqdwq0lh5b Twitter

States Boost Earned Income Tax Credits For Pandemic Relief

9m In More Tax Credits Available For Maryland Student Loan Debt

Tax Credits Deductions And Subtractions

If You Are A Nonresident Employed In Maryland But Living In A Jurisdi

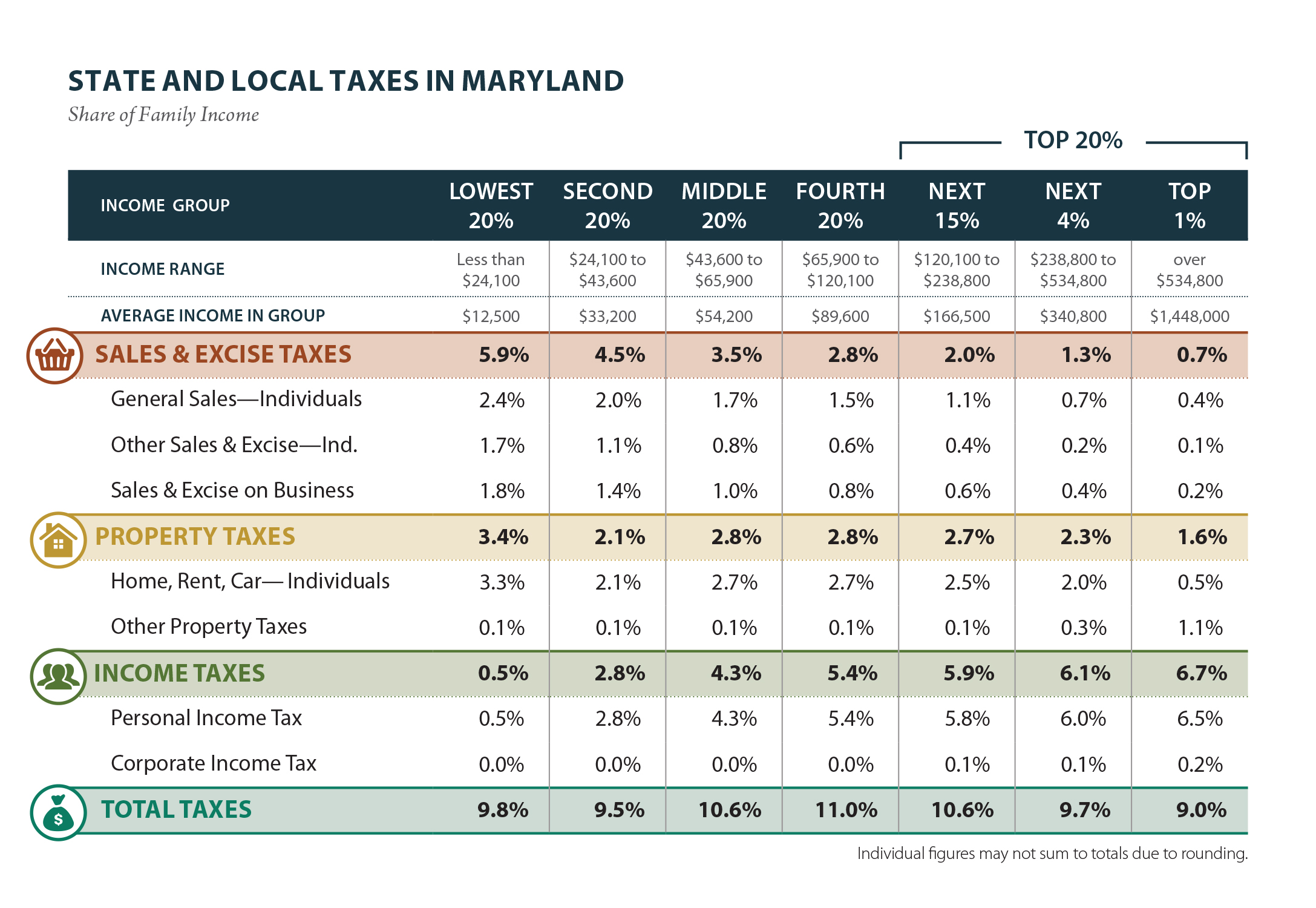

Maryland Who Pays 6th Edition Itep

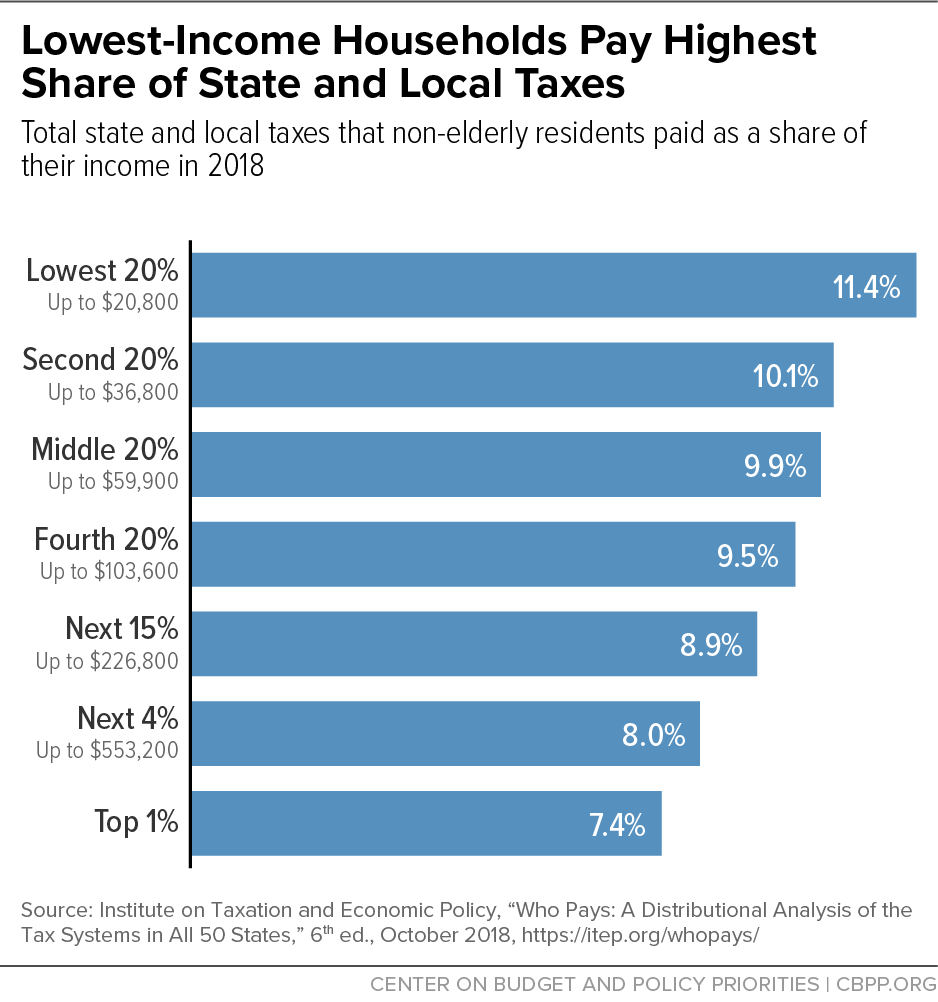

States Can Adopt Or Expand Earned Income Tax Credits To Build Equitable Inclusive Communities And Economies Center On Budget And Policy Priorities

The Supreme Court Declares Maryland Resident Tax Credit Structure Unconstitutional Because It Leads To Double Tax Noonan S Notes Blog

State Earned Income Tax Credits Urban Institute

The Right Thing To Do Md Comptroller Applauds Passage Of Bill Expanding Earned Income Tax Credit 47abc

States Can Adopt Or Expand Earned Income Tax Credits To Build Equitable Inclusive Communities And Economies Center On Budget And Policy Priorities

Maryland Volunteer Lawyers Service Eitc Can Give Qualifying Workers With Low To Moderate Income A Substantial Financial Boost To Receive The Credit People Must Meet Certain Requirements Use The Irs Eitc Assistant To Check

Earned Income Tax Credit Overview

Maryland Community Action Partnership Rescue And Relief Toolkits

Expanding The Maryland Earned Income Tax Credit Eitc Sign On Survey